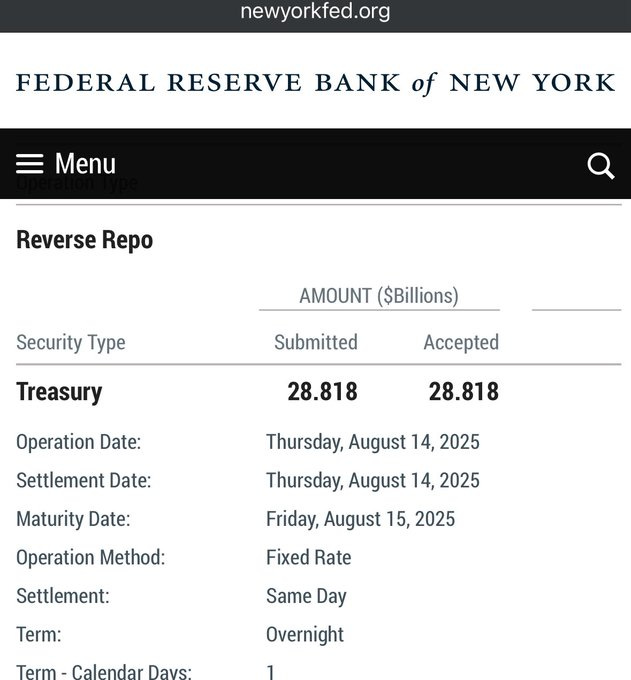

On August 14, 2025, the Federal Reserve’s Reverse Repo (RRP) facility collapsed to just $28.8 billion — effectively empty after once holding over $2.5 trillion. For a system built on “liquidity buffers,” this is a dangerous moment. When the RRP drains, the next buffer is bank reserves. And once reserves fall too low, repo markets seize, short-term rates spike, and the Fed is forced into emergency interventions — just like the repo crisis of 2019.

Fed Chair Jerome Powell still has one lever to pull: Quantitative Tightening (QT). By continuing to let Treasuries and mortgage-backed securities roll off the Fed’s balance sheet, Powell can try to keep reserves scarce, hold money market conditions tight, and maintain control of interest rates. In theory, QT is meant to suppress inflation and project discipline.

But in reality, QT has become Powell’s double-edged sword. The more he tightens, the more he:

-

Drains liquidity directly out of the system.

-

Pushes bank reserves toward scarcity, inviting repo market stress.

-

Amplifies housing and real estate crises, as high rates choke off credit.

Rather than reinforcing the Fed’s authority, QT risks triggering the very crisis that exposes its fragility.

This is the opening Donald Trump and Treasury Secretary Scott Bessent are waiting for. Constitutionally, Trump cannot order Powell to cut rates or end QT. But he doesn’t have to.

Instead, Sec. Bessent can deploy tools already within the Treasury’s authority to work around the Fed, providing liquidity on Treasury’s terms and building a parallel system that gradually displaces the Fed’s monopoly.

Powell Under Pressure

Trump has Powell cornered on multiple fronts.

-

Construction Scandal: The Fed’s $3.1–$3.5 billion headquarters expansion has become a lightning rod. Trump has blasted it as government waste, and Bessent has suggested opening an investigation into the project’s spending and contracting practices — a constitutionally valid move since it involves taxpayer funds.

-

Ethics Scrutiny: Powell is reportedly under investigation for accepting gifts and favors, adding personal scandal to institutional weakness.

-

Political Signaling: The Trump administration has openly said they are “looking for a new Fed Chair.” While Powell cannot be removed for policy disagreements alone, sustained investigations could provide grounds for a resignation by fall 2025.

This isn’t just a feud. It’s a deliberate strategy to weaken Powell’s credibility as QT tightens markets into crisis. The idea is to force Powell’s resignation or to keep him in check so that his next moves are aligned with Trump’s agenda.

The Perfect Storm of Crisis

As QT drains reserves, the broader economy is already cracking:

-

Housing Market Crunch – Too many homes, too few buyers, and mortgage rates stuck at suffocating levels.

-

Commercial Real Estate Implosion – Office vacancies and refinancing cliffs threaten cascading defaults.

-

Repo Fragility – With RRP nearly empty, QT is now hitting bank reserves, raising the risk of a funding seizure.

-

High Rates Entrenched – Powell insists on keeping rates “higher for longer,” even as markets buckle.

Taken together, QT doesn’t solve inflation — it creates a perfect storm. The Fed looks like it’s draining the lifeblood of the economy while refusing to change course.

It kept on this track, we will be heading towards and economic crisis. This is exactly what the Globalists and Deep State want. They want to impeded Trump’s progress and stifle economic recovery. Through this they can organize chaos and have an opportunity to regain control.

Bessent’s Constitutional Counter to QT

Here is where President Trump and Sec. Bessent’s parallel system comes in. They can’t stop QT directly — but they can work around it with constitutional authority already in Treasury’s hands:

1. Treasury Bond Issuance

Treasury has constitutional authority (delegated from Congress) to issue new debt. This includes 50-year gold and bitcoin-backed bonds. Stablecoin issuers could use these as collateral, minting U.S.-sanctioned digital dollars into circulation.

✅ 100% constitutional.

2. Exchange Stabilization Fund (ESF)

Created in 1934, the ESF gives Treasury broad powers to intervene in currency and credit markets. Bessent could tap the ESF to inject liquidity directly into repo markets, bypassing the Fed.

✅ Constitutional precedent: the ESF has been used for FX and credit interventions for decades.

3. Treasury Stablecoin

Framed as modernizing debt issuance, Treasury could issue a blockchain-based stablecoin backed by T-bills, gold, or Bitcoin. This creates a parallel liquidity rail where short-term funding costs are set by Treasury, not the Fed.

✅ Constitutional gray zone but defensible — it falls under Treasury’s debt management powers.

4. Congressional Oversight

Congress can investigate Fed spending — including the HQ expansion — and subpoena Powell for testimony. Coordinated with Treasury probes, this becomes both a political and financial squeeze.

✅ Fully constitutional.

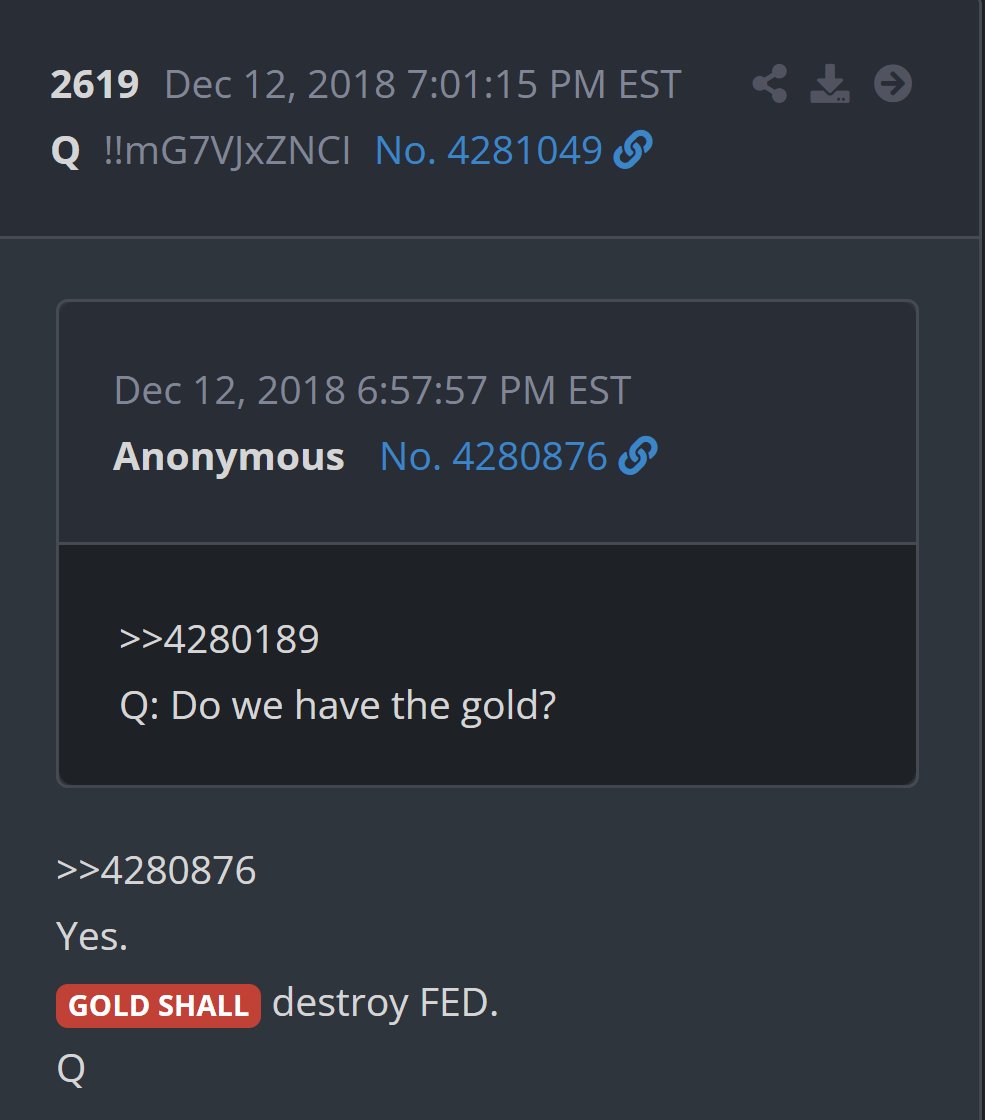

Gold Shall Destroy the Fed

QT starves the economy of liquidity. Gold-backed Treasury bonds could flood it back in — but under Treasury’s control, not the Fed’s.

-

50-Year Gold Bonds: Anchor stablecoin issuance to a hard asset.

-

Stablecoin Adoption: Private issuers (Circle, Tether, fintechs) mint digital U.S. dollars backed by Treasury-approved collateral.

-

Global Demand: Foreign central banks and investors shift into gold-backed U.S. debt instruments, bypassing Fed liabilities.

-

Fed Displacement: Liquidity provision moves from the Fed’s shrinking balance sheet to Treasury’s expanding gold-backed rails.

This is how the Q Boards “gold shall destroy the Fed” becomes operational. Powell’s QT shrinks him out of relevance, while Bessent’s gold-backed liquidity system grows into dominance.

The Sovereign Wealth Fund Future

Longer term, these moves could evolve into a U.S. sovereign wealth fund, pooling Treasuries, gold, and Bitcoin into a stabilization basket. The Treasury already operates the Exchange Stabilization Fund; scaling it would be constitutional and straightforward.

This fund could function like the IMF’s SDR basket — but instead of foreign multilateral control, it would be anchored directly in U.S. assets, under Treasury management.

The Rise of a Parallel System

QT is Powell’s last stand — his final attempt to maintain control by starving the system of liquidity. But in trying to prove the Fed’s independence, Powell is also tightening into fragility, ensuring that his very policies set the stage for failure. History has shown that when liquidity runs dry, markets do not wait patiently for the Fed to act. They seize, they panic, and they seek alternatives.

Trump and Bessent cannot constitutionally command the Fed to cut rates or end QT. The Federal Reserve Act protects that independence. But what they can do — and what they appear to be preparing to do — is build a parallel system of liquidity provision outside of Powell’s reach. One rooted not in fiat promises but in hard assets and market demand.

That parallel system would be grounded in:

-

50-year gold- and bitcoin-backed bonds, creating a new class of hard-backed collateral.

-

The Exchange Stabilization Fund, used as a Treasury lever to inject liquidity directly into stressed markets.

-

A Treasury-backed stablecoin, programmable and globally adoptable, circulating alongside — and eventually in place of — Fed liabilities.

-

A campaign of investigations and political pressure, weakening Powell’s legitimacy and potentially forcing his resignation.

At first, this Treasury system would coexist with the Fed. It would be a supplement, an experiment, a modernization project. But over time, as Powell’s QT shrinks the Fed into irrelevance and Bessent’s asset-backed architecture grows in adoption, the balance of power shifts. Liquidity-starved markets will naturally gravitate to the safer, more transparent, and more market-driven rails offered by Treasury.

This is not the end of central banking by legislation. It is displacement by evolution. Just as the IMF’s SDR basket offered a multilateral alternative to national reserves, a U.S. Treasury SDR-style system — rooted in gold, resources, assets, Bitcoin, and Treasuries — could become the preferred anchor for global liquidity. Unlike the Fed’s closed, technocratic model, this system would function more like a free market, where hard-backed bonds, sovereign wealth assets, and digital rails compete for adoption.

And once that shift occurs, the Federal Reserve no longer needs to be abolished. It simply becomes unnecessary.

As Q Said, “Gold shall destroy the Fed” and it looks more and more like this is the blueprint — and in 2025, it may already be the constitutional plan in motion.